Trends in Embedded Finance: Integrating Financial Services into Everyday Apps

world777 login, 11xplay online, betbook247:In today’s digital age, the way we interact with financial services is rapidly evolving. Gone are the days of having to visit a physical bank branch to deposit a check or transfer money. Instead, financial services are increasingly being embedded into everyday apps that we use, making our financial lives more convenient and seamless than ever before.

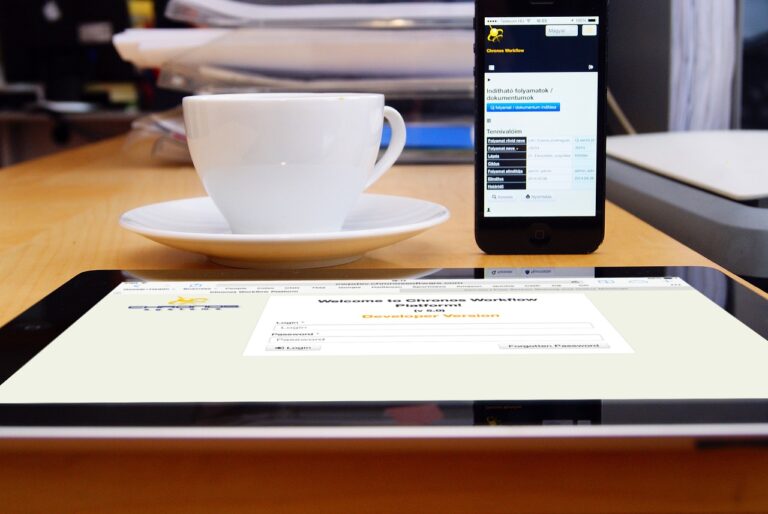

This trend towards embedded finance is revolutionizing the way we manage our money, from personal budgeting to investing. By integrating financial services into apps that we already use on a daily basis, such as shopping apps, ride-sharing apps, and even social media platforms, users can access a wide range of financial products and services without ever having to leave the app.

One of the key drivers of this trend is the rise of APIs (Application Programming Interfaces), which allow different apps and software systems to communicate with each other. By leveraging APIs, developers can easily integrate financial services like payments, lending, and investments into their own apps, creating a seamless experience for users.

For example, imagine being able to apply for a loan or set up a savings account directly within your favorite shopping app. Or being able to split bills with friends and family right through a messaging app. These are just a few examples of how embedded finance is changing the way we interact with financial services.

As more and more companies embrace embedded finance, we can expect to see a wide range of new and innovative financial products and services being offered through everyday apps. From personalized budgeting tools to automated investment platforms, the possibilities are endless.

Heading 1: The Benefits of Embedded Finance

Embedded finance offers a wide range of benefits for both consumers and businesses. For consumers, it provides a more convenient and seamless way to access and manage their finances. With financial services integrated directly into the apps they already use, users can save time and effort by avoiding the need to switch between multiple apps and websites.

For businesses, embedded finance presents new opportunities to monetize their platforms and engage with customers in new ways. By offering financial products and services within their apps, businesses can create additional revenue streams and enhance the overall user experience.

Heading 2: The Rise of Fintech and Open Banking

The growth of embedded finance can also be attributed to the rise of fintech companies and open banking regulations. Fintech companies are disrupting the traditional financial services industry by offering innovative and user-friendly financial products and services. Open banking regulations, which require banks to open up their APIs to third-party developers, have also played a key role in enabling the integration of financial services into everyday apps.

Heading 3: Examples of Embedded Finance in Action

There are already numerous examples of embedded finance in action across a wide range of industries. For instance, ride-sharing apps like Uber and Lyft allow users to pay for their rides directly within the app, without the need for cash or a credit card. Similarly, shopping apps like Amazon and eBay offer a variety of payment options, including buy now, pay later services and installment plans.

Heading 4: The Future of Embedded Finance

As technology continues to advance and consumer expectations evolve, we can expect to see even more innovation in the field of embedded finance. From AI-powered financial advisors to blockchain-based payment systems, the possibilities for embedded finance are virtually endless.

Heading 5: Challenges and Considerations

While embedded finance offers a host of benefits, it also comes with its own set of challenges and considerations. For instance, ensuring the security and privacy of user data is crucial when integrating financial services into apps. Additionally, navigating the complex regulatory landscape surrounding financial services can be a daunting task for developers and businesses alike.

Heading 6: Conclusion

In conclusion, embedded finance is revolutionizing the way we interact with financial services, making our financial lives more convenient and seamless than ever before. By integrating financial products and services into everyday apps, we can expect to see a wide range of new and innovative solutions that cater to the evolving needs of consumers. As technology continues to evolve, the future of embedded finance looks brighter than ever.

FAQs:

1. What are some common examples of embedded finance in everyday apps?

2. How can businesses benefit from integrating financial services into their apps?

3. What are some of the key challenges associated with embedded finance?

4. What role do APIs play in enabling embedded finance?

5. How can consumers ensure the security of their financial data when using embedded finance apps?