Business Review: Traditional Banks Implementing Voice Banking Solutions

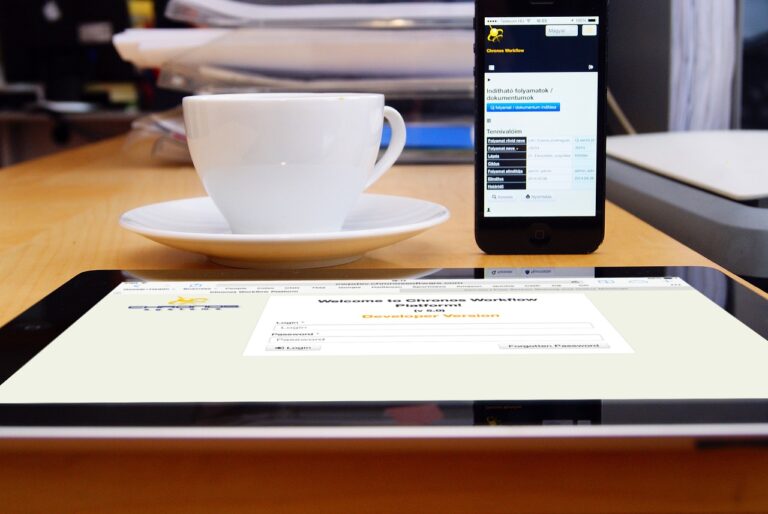

cricketbets999.com login, 11xplay reddy login, betbhai 9.com:In recent years, traditional banks have been implementing voice banking solutions as a way to modernize and enhance the customer experience. Voice banking allows customers to perform various banking transactions and inquiries using their voice through devices like smart speakers and smartphones. This technology is revolutionizing the way customers interact with their banks and is becoming increasingly popular in today’s digital age.

Voice banking solutions offer a convenient and efficient way for customers to manage their finances. By simply speaking commands, customers can check their account balances, transfer funds, pay bills, and even get personalized financial advice. This hands-free approach to banking is particularly appealing to busy individuals who are always on the go and value convenience.

One of the key benefits of voice banking is its ease of use. Customers can access their accounts and perform transactions with just a few spoken words, eliminating the need to navigate through a website or mobile app. This simplicity makes banking tasks quicker and more convenient, ultimately improving the overall customer experience.

Additionally, voice banking solutions are also improving security measures. Biometric voice recognition technology is being used to verify a customer’s identity, adding an extra layer of security to transactions. This helps reduce the risk of fraud and enhances customer trust in the banking system.

Furthermore, traditional banks are leveraging voice assistants like Amazon’s Alexa and Google Assistant to provide customers with a seamless banking experience. Through these voice-activated devices, customers can ask questions, receive account updates, and even make payments without having to pick up a phone or visit a branch.

Overall, the implementation of voice banking solutions by traditional banks is a positive step towards embracing innovation and meeting the evolving needs of customers. By integrating voice technology into their services, banks are able to offer a more personalized and convenient banking experience that sets them apart from their competitors.

Heading 1: The Rise of Voice Banking in Traditional Banks

Voice banking is gaining traction in the banking industry as more traditional banks adopt this innovative technology to enhance their services.

Heading 2: Benefits of Voice Banking Solutions

Voice banking offers several benefits to both customers and banks, including convenience, ease of use, enhanced security, and improved customer experience.

Heading 3: How Voice Recognition Technology Works

Voice recognition technology is at the core of voice banking solutions, allowing for secure and accurate identification of customers through their unique voice patterns.

Heading 4: Integrating Voice Assistants into Banking Services

Traditional banks are integrating popular voice assistants like Amazon’s Alexa and Google Assistant to provide customers with a seamless banking experience.

Heading 5: Customer Adoption of Voice Banking Solutions

Customers are increasingly embracing voice banking solutions for their convenience and efficiency, making it a popular choice for managing finances on-the-go.

Heading 6: Future Trends in Voice Banking

As voice technology continues to advance, we can expect to see more features and capabilities being integrated into voice banking solutions to further enhance the customer experience.

Heading 7: FAQs

What devices can I use for voice banking?

Do voice banking solutions offer the same level of security as traditional banking methods?

How can I get started with voice banking at my traditional bank?

Are there any fees associated with using voice banking services?

Do voice banking solutions support multiple languages for customer interactions?

Can I access all of my banking services through voice banking solutions, including loans and investments?

In conclusion, voice banking solutions are revolutionizing the way customers interact with traditional banks, offering a more personalized and convenient banking experience. As this technology continues to evolve, we can expect to see even more innovative features and functionalities being integrated into voice banking solutions. Traditional banks that embrace voice banking stand to benefit from increased customer satisfaction and loyalty in today’s fast-paced digital world.